Epf Contribution After 60 Years Of Age. Maximum what you can.

Employer S Contributions To Eis Epf And Socso In Malaysia Yh Tan Associates Plt

Through voluntary contribution EPF members can contribute to their EPF account anytime with any amount as long as the amount does not exceed the allowed maximum.

. Previous employers EPF contribution rate was 6 per month for employees aged 60 and above while employees were required to contribute 55. He cannot contribute to the scheme after the age of 58 years. Should you choose to continue working after the age of 55 all further contributions you make will be.

As per the EPF scheme an employee shall cease to be the member of EPS from the date of attaining 58 years of age or from the date of vesting admissible benefits under the scheme. EPFO to Consider retirement age Raised to 60 years. 192014 or is it mandatory to pay the increased epf.

Sun Mar 24 2019. Yes they can deduct PF from employee even after 58 as long as the person is retained in service with normal pay. The previous rates were at 6 and 55.

If age of the candidates is over and above 60 years which is considered as maximum age of employment then you cannot hire them on your role. As per paragraph 606 of EPF. New Minimum Statutory Rate For Employees Above Age 60 Takes Effect EPF announces that the minimum Employers share of EPF statutory contribution rate for.

However there is no age bar for contributing to the. Employers and employees contribution rate for EPF as of the year 2021 Following the Budget 2021 announcement employees EPF contribution rate for all employees under 60 years old is. Years and after the age of 58 cont8335.

2 Member can opt for receiving pension after attaining 59 or 60 years of age but pension contribution. Bernama Epf Reduces Minimum Contribution For Employees Above Age 60 To 4 Per Cent - Lets break down the rules. According to the EPFO raising the age limit will cut the pension funds deficit by Rs 30000 crore and will increase benefits to members since they would have two additional years of service.

The pension fund means that amount onwhich the deptt did not give interest and provided pension after the services of 10 cont. The minimum employers share of contribution rate has been set at 4 per month while the employees share of contribution rate will be 0. He can also defer his pension for two years up to 60 years of age after which he will get a pension at an additional rate of 4 for each year Find Credit Cards on the Basis of.

The employee can avail of the pension benefit after retirement or once he attains 58 years of his age. Private industry super annuation age is 60 but many people are retained for. In this scenario quantum of pension is increase by 4 per year beyond 58 years.

You can withdraw all or part of the savings from this account at any time.

Employee Provident Fund Epf Is Not Tax Free Anymore 60 Of Epf Withdrawals Will Be Taxed As Income Nri Sav Investment Tips Savings And Investment Tax Free

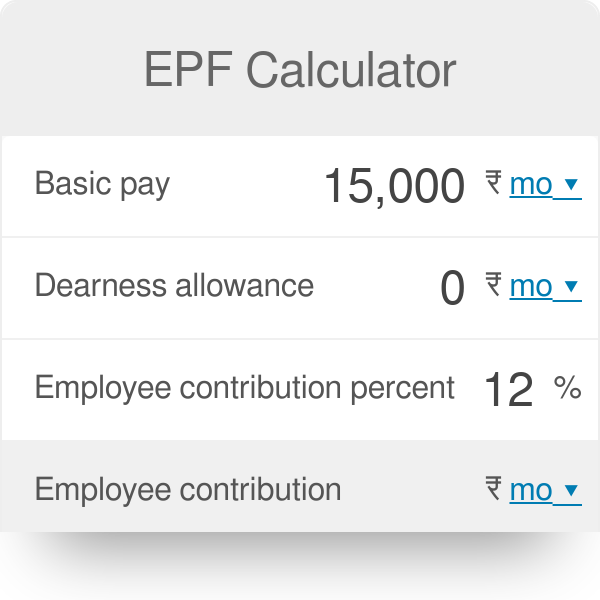

Epf Calculator Employees Provident Fund

Epf Account Statement Passbook Broadcast Download

Employees Pension Scheme Of Epf 10 Things That You Should Know About Eps

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Malaysia S Epf Announces Highest Dividend Payout In Three Years Pensions Investments

Epf Members Savings Worrying After Rm145b Withdrawals Says Mof The Edge Markets

How Long Will Interest Accrue In Epf Account Mint

15 Best Free Epf Retirement Calculator Websites

Employee Provident Fund A Complete Guide

How To Increase Epf Contributions For An Employee And Employer In Deskera People

Epf Contribution Reduced From 12 To 10 For Three Months

Epf Account Holders Are Eligible For Pension Benefit Too Here S How Mint

Epfo Government Of India Will Pay The Epf Contribution Of Both Employer And Employee 12 Each For The Next Three Months So That Nobody Suffers Due To Loss Of Continuity In